cash liquidation distribution box 9 lacerte Liquidation distributions, reported on Form 1099-DIV, are distributed when a . Metal stamping is an incredibly versatile and efficient manufacturing process that takes flat metal sheets or coils and transforms them into precisely shaped and intricate parts. By utilizing force, pressure, and specialized tooling, .

0 · liquidation distribution proceeds

1 · line 9 cash liquidation distribution

2 · cash liquidation distributions

3 · cash liquidation distribution form

4 · Lacerte box 1099

5 · Lacerte 1099 div box 9

6 · 1099 liquidation distributions

Sheet metal forming focuses on shaping flat metal sheets into specific designs through bending, stretching, drawing, and stamping. Unlike other manufacturing methods, such as machining or casting, sheet metal forming offers a more efficient way to produce lightweight and strong components.

Intuit Lacerte doesn't currently have dedicated input fields for 1099-DIV boxes 9 and 10. Follow the steps below to input. Go to Screen 17, Dispositions to enter the transaction.Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in .

If your client receives a cash liquidation distribution, you have to find out the .Liquidation distributions, reported on Form 1099-DIV, are distributed when a .Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There . Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule .

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final .

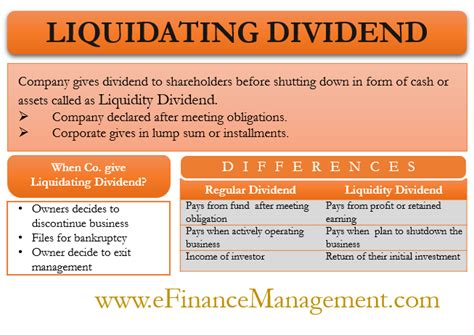

Liquidation distributions, reported on Form 1099-DIV, are distributed when a corporation in which you own stock is going through a partial or complete liquidation. The .

1099-DIV box 8 and 9. I have a 1099-DIV with cash liquid distribution (Box 8) from inheritance and also non-cash distribution (Box 9). How and where do I report the Box 9? Is the fair market . Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these .Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. These distributions are, at least in .

Some boxes don't have direct inputs in Lacerte. If you need assistance entering: Cash liquidation distributions (box 9), see here. Noncash liquidation distributions (box 10), see .Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in .

You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 8 or 9. Any liquidating distribution you receive is not taxable .

Intuit Lacerte doesn't currently have dedicated input fields for 1099-DIV boxes 9 and 10. Follow the steps below to input. Go to Screen 17, Dispositions to enter the transaction. Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property.

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. . Liquidation distributions, reported on Form 1099-DIV, are distributed when a corporation in which you own stock is going through a partial or complete liquidation. The amount of the liquidation reduces your basis in the stock.

1099-DIV box 8 and 9. I have a 1099-DIV with cash liquid distribution (Box 8) from inheritance and also non-cash distribution (Box 9). How and where do I report the Box 9? Is the fair market value of it considered interest? Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these boxes . click that and fill in the box amount for box 8 for the amount reported.

liquidation distribution proceeds

Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. These distributions are, at least in part, one form of a return of capital. They may be paid in one or more installments. Some boxes don't have direct inputs in Lacerte. If you need assistance entering: Cash liquidation distributions (box 9), see here. Noncash liquidation distributions (box 10), see here. Exempt-Interest Dividends (box 11), see here.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment. You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 8 or 9. Any liquidating distribution you receive is not taxable to you until you have recovered the basis of your stock .

Intuit Lacerte doesn't currently have dedicated input fields for 1099-DIV boxes 9 and 10. Follow the steps below to input. Go to Screen 17, Dispositions to enter the transaction. Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property. If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. . Liquidation distributions, reported on Form 1099-DIV, are distributed when a corporation in which you own stock is going through a partial or complete liquidation. The amount of the liquidation reduces your basis in the stock.

1099-DIV box 8 and 9. I have a 1099-DIV with cash liquid distribution (Box 8) from inheritance and also non-cash distribution (Box 9). How and where do I report the Box 9? Is the fair market value of it considered interest? Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these boxes . click that and fill in the box amount for box 8 for the amount reported.Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. These distributions are, at least in part, one form of a return of capital. They may be paid in one or more installments.

fabrication characterization and modeling of metallic source drain mosfets

Some boxes don't have direct inputs in Lacerte. If you need assistance entering: Cash liquidation distributions (box 9), see here. Noncash liquidation distributions (box 10), see here. Exempt-Interest Dividends (box 11), see here.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment.

fabrication methods for metal hose

What is a Junction Box: Discover the essential functions of junction boxes in electrical wiring systems. Learn about different types, their key.

cash liquidation distribution box 9 lacerte|cash liquidation distribution form