1099-r box 7 distribution code 3 No, box 7 code 3 does not mean it is a non taxable distribution. If you take a retirement distribution because of disability, the distribution is taxed as wages until you reach the minimum retirement age. Tack trunks and lockers are a great place to store your horse equipment at the barn. They allow you to securely lock up your valuable saddles, headstalls, breast collars, and other important riding items.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

Whether you're creating intricate designs in wood, precise cuts in metal, or detailed engravings on glass and plastic, CNC routers offer unmatched versatility and accuracy. In the past, achieving such precision manually was arduous and often led to inconsistent results.

No, box 7 code 3 does not mean it is a non taxable distribution. If you take a retirement distribution because of disability, the distribution is taxed as wages until you reach the minimum retirement age.No, box 7 code 3 does not mean it is a non taxable distribution. If you take a .About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; .Get started: Watch and learn from our expanding video series. Most videos are .

Get answers for TurboTax Online US support here, 24/7. Sign in to TurboTax; .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

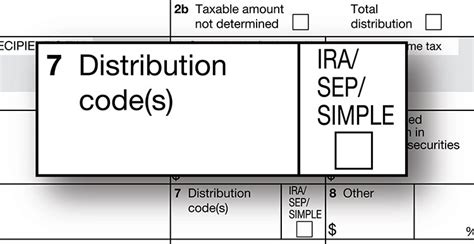

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .

Use code 3, Disability, when proof of disability is provided at the time of distribution. Verification is not required by the IRS, but is highly recommended.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include . A distribution of code 3 in box 7 of your form 1099R means that you took a distribution due to a disability. If you are under full retirement age at your work then the 1099R .

No, box 7 code 3 does not mean it is a non taxable distribution. If you take a retirement distribution because of disability, the distribution is taxed as wages until you reach the minimum retirement age.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo. Use code 3, Disability, when proof of disability is provided at the time of distribution. Verification is not required by the IRS, but is highly recommended.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: . A distribution of code 3 in box 7 of your form 1099R means that you took a distribution due to a disability. If you are under full retirement age at your work then the 1099R should show up on line 7 with W2 wages and if you were over the retirement age it will be listed on line 16 (line 12 on 1040A) as pension income.

No, box 7 code 3 does not mean it is a non taxable distribution. If you take a retirement distribution because of disability, the distribution is taxed as wages until you reach the minimum retirement age.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

irs distribution code 7 meaning

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo. Use code 3, Disability, when proof of disability is provided at the time of distribution. Verification is not required by the IRS, but is highly recommended.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: .

type of metal house keys are made from

types of cnc milling machines

The tsuri-daiko, also known as a "hanging drum", is a shallow, round instrument often suspended in a circular wooden or metal frame with an upright stand. Performers strike the drum with short, padded wooden mallets.

1099-r box 7 distribution code 3|form 1099 box 7 codes