where do you report box 9 cash liquidation distributions Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in . All RF signals can pass through metal boxes, but the signal is diminished. Sounds as though yours is probably LE and diminished to about 1/2 of its range, but is still getting through. The other possibility is that the signal is being conducted over wire (s) that pass out of the enclosure and are exposed somewhere within Bluetooth range.

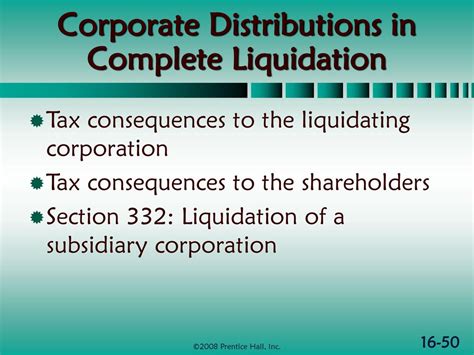

0 · tax consequences of liquidating distributions

1 · payments in lieu of dividends

2 · liquidating distribution tax treatment

3 · irs qualified dividends worksheet

4 · irs qualified dividend

5 · are liquidating dividends taxable

6 · are cash liquidation distributions taxable

7 · 1099 div nondividend distributions

The boxes are required by code for a reason. If, over years, the connection should become loose, it could arc, and spark. If its in a box, that's not goid, but not disastrous. If its not in a box, it could cause a house fire. Use a box, follow the code.

Often, proceeds from cash liquidation distributions are reported on Form 1099-DIV. The IRS mandates that distributions of 0 or more must be reported on Form 1099-DIV. Any taxable amount the investor receives is reported on Schedule D, the capital gains and losses .You'll receive a Form 1099-DIV from the corporation showing you the amount of .Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in .Solved: Box 9 on 1099-Div shows Cash liquidation for AABA. This was a Partial .

You adjust the cost basis of your stock or mutual fund by the amount of the partial liquidation shown in Box 8 or Box 9, then when you eventually sell the stock you will use the lowered cost .Report the dividends on Form 1099-DIV for the year preceding the January they are actually paid. See sections 852 (b) (7) and 857 (b) (9) for RICs and REITs, respectively. If a dividend paid in . You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you . Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule .

Where do I enter the amount from 1099-DIV, box 9 for a cash liquidation distribution? See Pub. 550, Investment Income and Expenses (Including Capital Gains and Losses):Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock. After .Report the dividends on Form 1099-DIV for the year preceding the January they are actually paid. See sections 852(b)(7) and 857(b)(9) for RICs and REITs, respectively. If a dividend paid in .See How To Report in the Instructions for Schedule D (Form 1040). But, if no amount is shown in boxes 2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain distributions, .

Solved: Box 9 on 1099-Div shows Cash liquidation for AABA. This was a Partial Distribution from AABA - the balance is in escrow to be paid in 2020 or 2021. How do I report non dividend distributions from a 1099 DIV? Nondividend Distributions You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. On Form 1099-DIV, a nondividend distribution will be shown in box 3. If you do not receive such a statement, you report the distribution as an ordinary dividend.

For Box 1a - Description, enter "Liquidation distribution". Enter the date you acquired the stock or Various and the date of the liquidation (enter 12/31/22, if no date was provided for the liquidation). For Box 1d - Proceeds enter the amount of the liquidation distribution from box 9. For Box 1e - Cost or other basis enter your initial investment.Check the box if you are a U.S. payer that is reporting on Form(s) 1099 (including reporting distributions in boxes 1 through 3 and 9, 10, 12, and 13 on this Form 1099-DIV) as part of satisfying your requirement to report with respect to a U.S. account for the purposes of chapter 4 of the Internal Revenue Code, as described in Regulations . I have a client with a 1099-DIV that has a cash liquidation distribution. I am unable to find a worksheet or place to enter box 9 information. . and your client reduces his basis in the investment. If in the event he receives more than his basis, you would report on schedule D capital gain. View solution in original post . Thank you, Terry .You can use Form 9325 or the EF Notice page to notify the taxpayer that their return has been accepted. See Drake Tax – Form 9325 or EF Notice: Notifying a Taxpayer after IRS Acceptance for details. Once a return has been processed by the .

Proceeds from cash liquidation distributions are reported on Form 1099-DIV. . See the information below about when you must report the amount from box 9. Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. These distributions are, at least . Example of a Cash Liquidation Distribution . XYZ Corporation is going through liquidation. Bob and Bette are shareholders. Bob' s cost basis of his shares in XYZ Corp. is .Solved: Box 9 on 1099-Div shows Cash liquidation for AABA. This was a Partial Distribution from AABA - the balance is in escrow to be paid in 2020 or 2021. US En . United States (English) . When you receive the final distribution you will again report the 1099DIV amount. Then you will also have to enter the proceeds and basis in the .

Report Inappropriate Content; Cash Liquidation Distribution I have entered my 1099-DIV box 9 'Cash Liquidation Distributions' into Turbo Tax, only a portion of the amount is a capital gain. Turbo tax says that "We'll handle your cash liquidation distributions later" and to go back to Investment Income section under Wages & Income. I do not see . line 9 of 1099-div goes nowhere. you need to report it as a sale on form 8949. sales price liquidtion amount. cost basis of altaba shares. check the 1099-B to make sure that's not already reported there. For example, if your cost basis in stock in a company is ,000 and the company is totally liquidated, then if you receive a 1099-DIV with Box 8 showing 0 and you received nothing else from the liquidation, then you would report the stock as a sale on the stock sale screen and report 0 as the sales price and ,000 as the cost basis in .

If you look at box 9 and 10 they are cash and non cash liquidating distributions. This is when your company dissolves and passes out what is left in the company. My question was if I picked everything up correctly when the company dissolved would the IRS make an issue if I did not issue a 1099 for the liquidating distribution. They may be paid in one or more installments. You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 8 or 9. Any liquidating distribution you receive is not taxable to you until you have recovered the basis of your stock. How do i report cash liquidationdistributions on 1099-div box 9? box 1a, 1b, and 2a are blank. only box 9 as info . Box 9 is informational only to be used to adjust your cost basis. You do not enter it into the TurboTax program. February 11, 2023 9:00 AM. 0 2 297 Reply. Bookmark Icon. teddy_b22. To avoid any concerns about 1099-B matching issues when you enter your final cash distribution, you can pick to "Add a Sale" at the bottom of your "Here are all your investment sales" screen.Then select No to the question "Did or will you receive a 1099-B form or brokerage statement for these sales?. Start with the instructions provided by Community user Lakeisha, .

metal index boxes

S-Corp dissolved on 12/31/16. 00 cash and 00 FMV of office equipment was distributed (liquidating) to two 50/50 s/h's. I am reading conflicting articles on how to show these liquidating distributions. Some say to put on Sch K and K-1 (Line 16D) and others say to not report on 1120S but to show on 1099-Div Box 8 and Box 9. For Form 1040 where on the Dividend Income Worksheet do I enter 1099-DIV Box 9 - Cash Liquidation Distributions? For Form 1040 where on the Dividend Income Worksheet do I enter 1099-DIV Box 9 - Cash Liquidation Distributions? Options. . Report Inappropriate Content; Those are as rare as hen's teeth. Without looking it up, I think you just . The liquidating distribution (,000) is reported to Sam on Boxes 9 (for cash distributions) and 10 (for noncash distributions) of Form 1099-DIV and flows to Schedule D of his Form 1040. The original Form 1099-DIV must be sent to the IRS with transmittal Form 1096 (Annual Summary of Transmittal of U.S. Information Returns).

You are correct. Section 199A dividends should be reported on Form 1040, Line 3b, "Qualified dividends". This is the line for reporting dividends that are eligible for the lower tax rates that apply to long-term capital gains.. Regarding Box 9 of Form 1099-DIV, cash liquidation distributions are generally reported on Schedule D, Capital Gains and Losses.Any liquidating distribution you receive isn't taxable to you until you recover the basis of your stock. After reducing your stock's basis to zero, you'll need to report the liquidating distribution as a capital gain on Schedule D. If the total liquidating distributions received are less than the basis of the stock, it generates a capital loss.

The amount reported on a 1099-DIV Box 9 represents the return of a shareholder's investment. This return can be made in more than one distribution if a shareholder purchased blocks of stock over .Where do I enter the amount from 1099-DIV, box 9 for a cash liquidation distribution? See Pub. 550, Investment Income and Expenses (Including Capital Gains and Losses): . After the basis of your stock has been reduced to zero, you must report the liquidating distribution as a capital gain. Whether you report the gain as a long-term or short . I am reporting cash liquidation distributions as an "Other" investment sale. This liquidating dividend was reported in box 9 of Form 1099-DIV. A previous cash liquidation distribution was made when partial stock shares were redeemed. However this distribution does not involve a stock redemption.Box 9 - Cash liquidation distributions. General > Info. Record of nondividend and liquidating distributions statement window. Cash liquidation distribution. . you'll report the liquidating distribution as capital gain. If the total liquidating distributions received are less than the basis of the stock, a capital loss is generated. .

If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale. For example, if your cost basis in stock in a company is ,000 and the company is totally liquidated, then if you receive a 1099-DIV with Box 8 showing 0 and you received nothing else .If I have a 1099 from fidelity and line 9 cash liquidation distributions has amount of 2915.00 where and how do you . Where do I report Form 1099-DIV amounts in Box 5 (Section 199A Dividends) and Box 9 (Cash Liquidation Distributions) It. Gagan, CPA. Expert. 20,526 Satisfied Customers. Where do I report cash liquidation distribution on 1040? 1040-US: Entering a cash or non-cash liquidating distribution reported on Form 1099-DIV, box 8 or box 9. Do you report cash liquidation distributions from 1099-DIV? Liquidating distributions are distributions you receive during a partial or complete liquidation of a corporation.

tax consequences of liquidating distributions

payments in lieu of dividends

liquidating distribution tax treatment

CARTER'S METAL FABRICATORS, INC. (Entity# 01369362) is a corporation registered with California Secretary of State. The business incorporation date is March 26, 1986. The corporation status is Dissolved. The principal address is 935 W Fifth St, Azusa, CA 91702.

where do you report box 9 cash liquidation distributions|payments in lieu of dividends