1099r distribution box 1 Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom . A press machine is a sheet metal working tool with a stationary bed and a powered ram can be driven towards the bed or away from the bed to apply force or required pressure for various metal forming operations.

0 · form 1099 r gross distribution

1 · form 1099 r distribution

2 · form 1099 r check box

3 · form 1099 r box 2b

4 · 1099 r pension distribution

5 · 1099 r ira distribution code

6 · 1099 r form box 3

7 · 1099 r distribution code

We find multiple types of junction boxes with their properties and advantages. For this reason, we categorize these electrical junction box types based on their features and applications. We will discuss each type in the .

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.File Form 1099-R for each person to whom you have made a designated distribution .

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From .

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. .

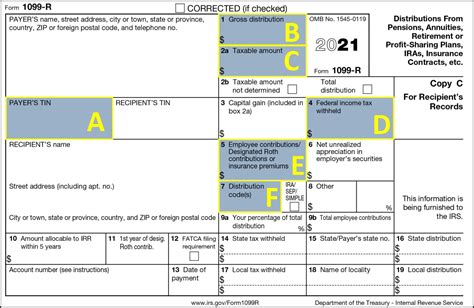

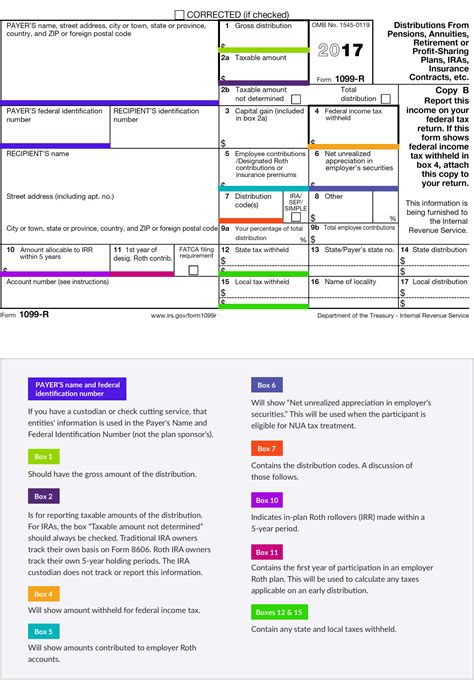

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a . For redeemed United States savings bonds, Box 1 will contain the value of bonds distributed from a plan. The taxable amount of redeemed bonds should appear in Box 2a. You should also receive a statement indicating the .

form 1099 r gross distribution

Distributions from a Roth IRA may be tax-free. You'll automatically receive Form 1099-R if you took at least in distributions from a relevant source. When tax season rolls .

Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the .

The image below highlights the 1099-R boxes most frequently used—and their explanations—for defined contribution plan distributions. . (as opposed to Code 8 with the .

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.

form 1099 r distribution

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirement plans, any individual .

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans. Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.

1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable. For redeemed United States savings bonds, Box 1 will contain the value of bonds distributed from a plan. The taxable amount of redeemed bonds should appear in Box 2a. You should also receive a statement indicating the value of each bond at the time of distribution.

Distributions from a Roth IRA may be tax-free. You'll automatically receive Form 1099-R if you took at least in distributions from a relevant source. When tax season rolls around, you'll probably receive a handful of documents. Form 1099-R might be among them. Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan.

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer. The image below highlights the 1099-R boxes most frequently used—and their explanations—for defined contribution plan distributions. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death)If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirement plans, any individual .

form 1099 r check box

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans. Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.

1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable. For redeemed United States savings bonds, Box 1 will contain the value of bonds distributed from a plan. The taxable amount of redeemed bonds should appear in Box 2a. You should also receive a statement indicating the value of each bond at the time of distribution. Distributions from a Roth IRA may be tax-free. You'll automatically receive Form 1099-R if you took at least in distributions from a relevant source. When tax season rolls around, you'll probably receive a handful of documents. Form 1099-R might be among them. Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan.

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.

how to make a ring out of sheet metal

how to make cnc machine program

Sheet metal bending types and techniques, including press brake and metal bending processes. Learn about the different methods and applications in bending sheet metal fabrication for various manufacturing needs.

1099r distribution box 1|1099 r form box 3