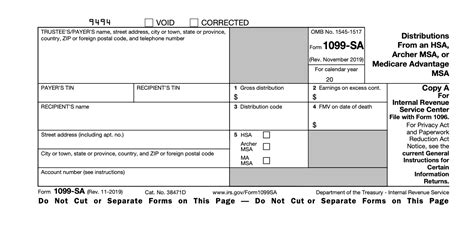

1099-sa box 3 distribution code If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical .

RECTANGULAR TUBING Lengths - 20, 24, 30, 36, 40, 48, 60 FT. Size & Wall Weight Per Foot Size & Wall Weight Per Foot 12 x 6 20 x 8 x 3/16 22.18 x 3/8 68.31

0 · is 1099 sa taxable income

1 · is 1099 sa considered income

2 · 1099 sa where to find

3 · 1099 sa where to enter

4 · 1099 sa qualified medical expenses

5 · 1099 sa payer name

6 · 1099 sa gross distribution mean

7 · 1099 sa federal id number

Set the Smoker Box right on top of your cooking grates to transform any gas grill into a smoke cooker to give your meats, veggies, nuts, and cheeses the mouthwatering smoky flavor you crave. The weather resistant Fuel Storage Bag keeps your wood pellets or charcoal dry and BBQ ready!

If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.File Form 1099-SA to report distributions made from a: Health savings account .Information about Form 5498-SA, HSA, Archer MSA, or Medicare Advantage .beneficiary in the year of death, issue a Form 1099-SA and enter in: • Box 1, the gross distribution; • Box 3, code 4 (see Box 3. Distribution Code, later); and • Box 4, the FMV of the account on .

If you get a distribution code No. 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. That means you must report at least some of the distribution as income on . If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical . There's no specific input for Box 3, Distribution Code, but it may help you decide which section to report the distributions in Screen 32.1, and whether any part of the distribution .

Complete form 5329 to report the excess contributions. Box 3: Distribution Code: Not Supported in program. Use this code for normal distributions to the account holder and any direct . Box 3 Distribution Codes. Form 1099-SA has a coding scheme on Box 3 that describes the type of distribution being recorded on the form. There are six types of distribution codes that are described below. Note that you may . All HSA gross distributions made during the year will be reported to the HSA owner in January following the year of distributions on IRS Form 1099-SA. Box 1 (see sample Form 1099-SA below) and further reported on IRS .

is 1099 sa taxable income

The earnings on the excess contributions were likely left on your HSA, so if you are taxed on it, you at least received it. When the distribution code on the 1099-SA is '2', then . Form 1099-SA form is sent to individual taxpayers who receive distributions from health savings, medical savings, and Medicare Advantage accounts. Information from Form 1099-SA is reported on.If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.

beneficiary in the year of death, issue a Form 1099-SA and enter in: • Box 1, the gross distribution; • Box 3, code 4 (see Box 3. Distribution Code, later); and • Box 4, the FMV of the account on the date of death. Distribution after year of death. If you learn of the death of the account holder and make a distribution after If you get a distribution code No. 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. That means you must report at least some of the distribution as income on your tax return.

sheet metal workers local 28

If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical expenses as income on your tax return. There's no specific input for Box 3, Distribution Code, but it may help you decide which section to report the distributions in Screen 32.1, and whether any part of the distribution should be excluded from the additional 10% tax. See the Form 1099-SA instructions for details on distribution codes.Complete form 5329 to report the excess contributions. Box 3: Distribution Code: Not Supported in program. Use this code for normal distributions to the account holder and any direct payments to a medical service provider. Use this code if no other code applies. Use this code for payments to a decedent's estate in the year of death. Box 3 Distribution Codes. Form 1099-SA has a coding scheme on Box 3 that describes the type of distribution being recorded on the form. There are six types of distribution codes that are described below. Note that you may receive multiple Form 1099-SA’s with different distribution codes.

All HSA gross distributions made during the year will be reported to the HSA owner in January following the year of distributions on IRS Form 1099-SA. Box 1 (see sample Form 1099-SA below) and further reported on IRS Form 8889 (see below). The earnings on the excess contributions were likely left on your HSA, so if you are taxed on it, you at least received it. When the distribution code on the 1099-SA is '2', then TurboTax adds only the amount in box 2 to your Other Income (line 21 on Schedule 1). Form 1099-SA form is sent to individual taxpayers who receive distributions from health savings, medical savings, and Medicare Advantage accounts. Information from Form 1099-SA is reported on.

If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.

beneficiary in the year of death, issue a Form 1099-SA and enter in: • Box 1, the gross distribution; • Box 3, code 4 (see Box 3. Distribution Code, later); and • Box 4, the FMV of the account on the date of death. Distribution after year of death. If you learn of the death of the account holder and make a distribution after If you get a distribution code No. 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. That means you must report at least some of the distribution as income on your tax return. If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical expenses as income on your tax return. There's no specific input for Box 3, Distribution Code, but it may help you decide which section to report the distributions in Screen 32.1, and whether any part of the distribution should be excluded from the additional 10% tax. See the Form 1099-SA instructions for details on distribution codes.

Complete form 5329 to report the excess contributions. Box 3: Distribution Code: Not Supported in program. Use this code for normal distributions to the account holder and any direct payments to a medical service provider. Use this code if no other code applies. Use this code for payments to a decedent's estate in the year of death. Box 3 Distribution Codes. Form 1099-SA has a coding scheme on Box 3 that describes the type of distribution being recorded on the form. There are six types of distribution codes that are described below. Note that you may receive multiple Form 1099-SA’s with different distribution codes.

All HSA gross distributions made during the year will be reported to the HSA owner in January following the year of distributions on IRS Form 1099-SA. Box 1 (see sample Form 1099-SA below) and further reported on IRS Form 8889 (see below). The earnings on the excess contributions were likely left on your HSA, so if you are taxed on it, you at least received it. When the distribution code on the 1099-SA is '2', then TurboTax adds only the amount in box 2 to your Other Income (line 21 on Schedule 1).

is 1099 sa considered income

sheet metal workers local 20 apprenticeship

sheet metal workers local 20 pay scale

Timex Unisex Weekender 38mm Watch with Slip-Thru Single Layer Strap . 4.8 4.8 out of 5 stars 5 ratings | Search this page . $59.95 $ 59. 95. FREE Returns . . Navy Fabric Slip-through Strap (20mm lug width) 30 meter water resistant; Mineral Glass Lens; Additional Information . Country of Origin. Philippines.

1099-sa box 3 distribution code|1099 sa where to find