cash liquidation distribution box 9 If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the . I received my 1099-R for making a 401k withdrawl from my former employer. The amount in box 1, however is not the amount I actually received when I got the check .

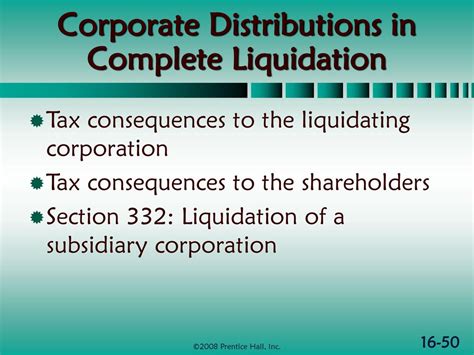

0 · tax consequences of liquidating distributions

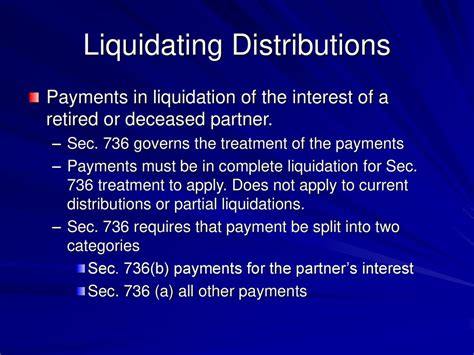

1 · payments in lieu of dividends

2 · liquidating distribution tax treatment

3 · irs qualified dividends worksheet

4 · irs qualified dividend

5 · are liquidating dividends taxable

6 · are cash liquidation distributions taxable

7 · 1099 div nondividend distributions

Sheet metal is generally composed of thin and flat sheets of metallic material. Its versatility makes it very useful for a broad range of applications and manufacturing processes.Sheet metal is metal formed into thin, flat pieces, usually by an industrial process. Thicknesses can vary significantly; extremely thin sheets are considered foil or leaf, and pieces thicker than 6 mm (0.25 in) are considered plate, such as plate steel, a class of structural steel. Sheet metal is available in flat pieces or . See more

Often, proceeds from cash liquidation distributions are reported on Form 1099-DIV. The IRS mandates that distributions of 0 or more must be reported on Form 1099-DIV. Any taxable amount the investor receives is reported on Schedule D, the capital gains and losses .

If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the .Box 9. Cash Liquidation Distributions. Enter cash distributed as part of a liquidation.

I have received at 1099-DIV with the amount of the check I received reported in .

Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in . You'll receive a Form 1099-DIV from the corporation showing you the amount of . Often, proceeds from cash liquidation distributions are reported on Form 1099-DIV. The IRS mandates that distributions of 0 or more must be reported on Form 1099-DIV. Any taxable amount the investor receives is reported on Schedule D, the capital gains and losses statement that is filed with the IRS form 1040 during yearly tax filings.

If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale.Box 9. Cash Liquidation Distributions. Enter cash distributed as part of a liquidation. I have received at 1099-DIV with the amount of the check I received reported in Box 9, "cash liquidation distributions." I entered the information from this 1099-DIV in TurboTax and then received the messages, "We'll handle your cash distribution of .

Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property. You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock.Section 331 (a) of the IRS tax code says that if a shareholder is eligible to receive a cash liquidation distribution totaling 0 or more, the distribution must be reported on Form.Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. These distributions are, at least in part, one form of a return of capital. They may be paid in one or more installments.

Box 9 on 1099-Div shows Cash liquidation for AABA. This was a Partial Distribution from AABA - the balance is in escrow to be paid in 2020 or 2021 (don't recall). The amount I received in Box 9 was more than my cost basis so I believe this is a capital gain. Just can't see how to show this in Turbotax.See what you need to do if you have data to enter in Box 9 from Form 1099-DIV. Also, follow the given steps to report a capital gain or loss on Schedule D.

tax consequences of liquidating distributions

Often, proceeds from cash liquidation distributions are reported on Form 1099-DIV. The IRS mandates that distributions of 0 or more must be reported on Form 1099-DIV. Any taxable amount the investor receives is reported on Schedule D, the capital gains and losses statement that is filed with the IRS form 1040 during yearly tax filings.If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale.Box 9. Cash Liquidation Distributions. Enter cash distributed as part of a liquidation. I have received at 1099-DIV with the amount of the check I received reported in Box 9, "cash liquidation distributions." I entered the information from this 1099-DIV in TurboTax and then received the messages, "We'll handle your cash distribution of .

16mm swa junction box

Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property. You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock.

Section 331 (a) of the IRS tax code says that if a shareholder is eligible to receive a cash liquidation distribution totaling 0 or more, the distribution must be reported on Form.

17 gauge sheet metal

payments in lieu of dividends

Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. These distributions are, at least in part, one form of a return of capital. They may be paid in one or more installments. Box 9 on 1099-Div shows Cash liquidation for AABA. This was a Partial Distribution from AABA - the balance is in escrow to be paid in 2020 or 2021 (don't recall). The amount I received in Box 9 was more than my cost basis so I believe this is a capital gain. Just can't see how to show this in Turbotax.

liquidating distribution tax treatment

Metal fabrication is a broad term referring to any process that cuts, shapes, or molds metal materials into a final product. Instead of an end product being assembled from ready-made components, fabrication entails creating an end product from raw or semi-finished materials.

cash liquidation distribution box 9|are liquidating dividends taxable