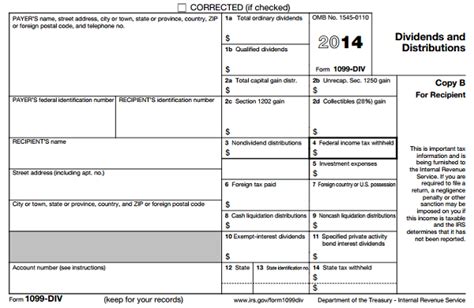

capital gain distribution box 2a is taxable Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and .

Junction boxes protect electrical wires from damage, prevent shocks, and stop sparks from igniting flammable material nearby. To install one, you’ll need to strip the ends off all the wires that will be in the box. To complete the electrical circuit, tie together the same-colored wires and hold them in place with wire nuts.

0 · form 1099 div box 2a

1 · form 1099 div box 12

2 · capital gain distributions tax treatment

3 · box 2a 1099 div

4 · box 12 exempt interest dividends

5 · are capital gains distributions taxable

6 · 1099 div box 12 states

7 · 1099 div 2a explained

Can you explain what G-code is used for in CNC machines? G-code is a programming language used by CNC machines to execute specific tasks. It stands for “Geometric Code” and guides the machine on where to move, the speed of movement, and the path to follow.

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.Consider capital gain distributions as long-term capital gains no matter how long .The profit paid out is a capital gain distribution. This also applies to pay outs made by crediting your cash account. For tax purposes, Form 1099-DIV , Box 2a reports your capital-gain .

Capital gain distributions, reported in Box 2a, are payments made by mutual funds or REITs from profits earned on the sale of securities. These distributions are taxable and should be reported as long-term capital gains on . Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities . Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and . Qualified dividends are generally taxed as long-term capital gains, with a tax rate of 0%, 15%, or 20%, depending on your income. Total capital gain distributions (Box 2a): If your investments paid out any capital gains (like .

Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), . Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for a profit. These are considered long-term capital gains . Capital gain distributions are normally reported to taxpayers on Form 1099-DIV (or an equivalent combined statement from certain brokerage firms). You can enter them into .If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.

If your investment makes a reportable capital gain distribution to you, it will be reported in box 2a. If any state and federal taxes were withheld from your distributions, those amounts will be reported in boxes 4 for federal withholding and 14 for state withholding.The profit paid out is a capital gain distribution. This also applies to pay outs made by crediting your cash account. For tax purposes, Form 1099-DIV , Box 2a reports your capital-gain distributions.

Capital gain distributions, reported in Box 2a, are payments made by mutual funds or REITs from profits earned on the sale of securities. These distributions are taxable and should be reported as long-term capital gains on your tax return, regardless of . Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities in a taxable account. Eventually corporations pay . Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and will come in to play when you sell your shares.

Qualified dividends are generally taxed as long-term capital gains, with a tax rate of 0%, 15%, or 20%, depending on your income. Total capital gain distributions (Box 2a): If your investments paid out any capital gains (like profits from the sale of assets), they’re reported here. Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), Capital Gains and Losses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for a profit. These are considered long-term capital gains and taxed at the long-term rates. Box 2b reports unrecaptured Section 1250 gains from real estate or REIT transactions .

Capital gain distributions are normally reported to taxpayers on Form 1099-DIV (or an equivalent combined statement from certain brokerage firms). You can enter them into TurboTax as follows: Scroll down through All Income and under the section for Interest & Dividends, select Start or Update across from "Dividends on 1099-DIV".

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.If your investment makes a reportable capital gain distribution to you, it will be reported in box 2a. If any state and federal taxes were withheld from your distributions, those amounts will be reported in boxes 4 for federal withholding and 14 for state withholding.

The profit paid out is a capital gain distribution. This also applies to pay outs made by crediting your cash account. For tax purposes, Form 1099-DIV , Box 2a reports your capital-gain distributions.

Capital gain distributions, reported in Box 2a, are payments made by mutual funds or REITs from profits earned on the sale of securities. These distributions are taxable and should be reported as long-term capital gains on your tax return, regardless of . Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities in a taxable account. Eventually corporations pay . Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and will come in to play when you sell your shares.

best metal roof for house

Qualified dividends are generally taxed as long-term capital gains, with a tax rate of 0%, 15%, or 20%, depending on your income. Total capital gain distributions (Box 2a): If your investments paid out any capital gains (like profits from the sale of assets), they’re reported here. Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), Capital Gains and Losses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for a profit. These are considered long-term capital gains and taxed at the long-term rates. Box 2b reports unrecaptured Section 1250 gains from real estate or REIT transactions .

form 1099 div box 2a

form 1099 div box 12

Upon completion of the apprenticeship, individuals achieve journey-level status, ready to pursue a career as a professional sheet metal worker. Sheet metal finds applications in diverse industries such as construction, HVAC, industrial settings, architectural metalwork, and more.

capital gain distribution box 2a is taxable|box 12 exempt interest dividends