the distribution code 7 on form 1099-r box 7 signifies L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after . $54.99

0 · irs distribution code 7 meaning

1 · irs 1099 distribution codes

2 · irs 1099 box 7 codes

3 · distribution code 7 normal

4 · distribution code 7 non disability

5 · 7d distribution code 1099

6 · 1099 box 7 code m

7 · 1099 4 box 7 codes

The role of a CNC operator is to set up and operate CNC machines and equipment. The operator unloads raw materials, prepares a test run, another role, and ensures that a well-functioning machine is working. An .

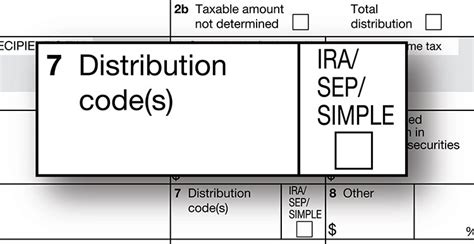

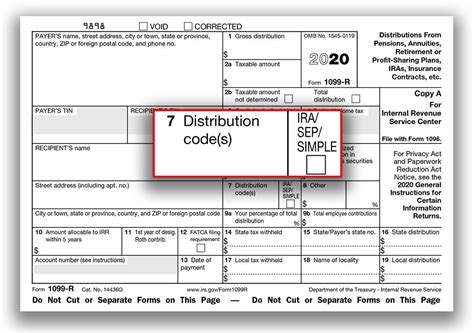

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event. Table of . L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after .

Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over . The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. On it, there is a Box 7. (Distribution Code(s)) where it says "2 - NONDISABILITY".TurboTax wants info for a box 7a AND a box 7b. What do I do? . My form has 7-Nondisability in Box 7a on CSA Form 1099-R, but there is no selection for that when filling out the Turbo Tax online form. What selection do I choose as there is nothing that shows Non . 1099-R with code 3 in box 7 for a disability pension at an age younger than the minimum work retirement age... since these distributions are taxed as wages until you reach the minimum retirement age and reported on line 7 of the 1040, this would be considered earned income and if that total is above ,500 (or ,500 if over 50) you could fund an ira for that tax .

What does Distribution Code T mean in box 7 of form 1099-R? It means a Roth IRA distribution, not subject to a early distribution penalty because the IRA owner is over age 59 1/2, disabled or died, but the payer does no know if the 5 year .

irs distribution code 7 meaning

This distribution will appear of Form 1040 lines 5a and 5b as a pension or annuity. Any Form 1099-R that is not from an a traditional IRA (IRA/SEP/SIMPLE box marked) or a Roth IRA (code J, T or Q in box 7) is reported as pension or annuity income. In this case, the code B indicates that this Roth account is not a Roth IRA.You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R. Who completes Form 1099-R?1099 R Code 1 in Box 7 of your 1099-R form signifies an early distribution with no known exception. This typically means that the amount distributed is subject to a 10% early withdrawal penalty in addition to regular income tax.1099-R Codes for Box 7. Haga clic para español. Revised 12/2018. Box 7 Code. . Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/ .

One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code(s) to enter in Box 7, Distribution code(s) on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. The following codes and explanations apply to IRA and QRP . The box 7 code was "J". . penalty on a 2021 Form 5329. The code-J distribution in 2022 corrects this excess and will reduce the ,000 excess carried into 2022 from 2021 to zero on the 2022 Form 5329. 2) Yes, codes J and P are correct for the return of the excess contribution for 2021. . the 2022 Form 1099-R with codes P and J for the .

A Form 1099-R without a code in box 7 is not valid. If you are over age 59½, are you sure that box 7 does not have code 7? It's not uncommon for people to miss seeing a code 7 since it is the same as the box number. . If it was a regular distribution, go ahead and put code 7 in box 7. As dmertz points out, a 1099-R without a code in box 7 is .

The IRS defines disability for the 1099-R as follows: "(7) Meaning of disabled. For purposes of this section, an individual shall be considered to be disabled if he is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or to be of long-continued and indefinite . The distribution code listed in box 7 of my 1099-R is "3" (disability). I am under the minimum retirement age and the past several years TurboTax has put my Gross Distribution on Form 1040 in box 1 (wages, salaries, tips, etc) because I am under minimum retirement age.Miriam received a Form 1099-R with distribution code 7. How should Miriam treat this distribution on her tax return? . Form 1099-DIV, Box 3. Self-employed individuals are allowed to make contributions to a SEP in 2022 of as much as 25% of their net self-employment income, up to an annual maximum of: . You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R. Who completes Form 1099-R?

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; Investment Advisor Support; Knowledge Center; . Form 1099-R must be sent no later than January 31 following the calendar year of the distribution. The image below highlights . No. If you properly already reported it in 2017 with a 8606 then you can ignore the 1099-R. A code R 1099-R does nothing - it just reports it to the IRS. If you already did then then ignore the 1099-R. A code R 1099-R does nothing whatsoever if entered into the 1099-R section of an amended 2017 return.The exception codes for line 2 of Form 5329 are different from the ones for Box 7 of Form 5329. But, yes, 02 is the correct code for your situation. You should try to file Form 5329 with your Form 1040. Your tax program should allow you to e-file, you don't need to mail it in separately. There is no need to ask for a corrected 1099. I agree, there should have been no code L1 2019 Form 1099-R since the loan was satisfied by the 2018 offset distribution reported on the code M1 2018 Form 1099-R and you had no loan in 2019 on which you could have defaulted in 2019. You need to obtain a corrected code L1 2019 Form 1099-R from the payer showing Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. Besides, it will also be reported on a Form 5498 "IRA Contribution Information" where box 11 and 12 will be checked .You are not . distributed.

Kacey’s Form 1099-R with a distribution code "7" indicates a normal distribution from a retirement plan, such as an IRA or 401(k), meaning that Kacey is at least 59½ years old and is receiving a regular, qualified distribution. Code 7 signifies that the distribution is not subject to the 10% early withdrawal penalty that applies to certain .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no .

You would enter the 1099-R with the total distribution in box 1 (the contribution plus the earnings), The earnings in box 2a, Enter code "P" in box 7 (Top) - don t worry that it will say "taxable in 2016 "Enter code "J" in box 7 (Bottom). On the "Which year" screen say that this is a 2018 1099-R. After the 1099-R summary screen press continue. If there is no code or number there, you should contact the Payor to get a corrected 1099-R. Here's some info about the codes in Box 7: The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions, to determine if your distribution is taxable or subject .B and 2 are two separate codes and must be entered individually in the two drop-down boxes on TurboTax's 1099-R form. Codes B and 2 together mean that the distribution was from a Designated Roth Account in a qualified retirement plan (B) but is not subject to an early-distribution penalty despite you having been under age 59½ at the time of the distribution (2). However the withdrawal wasn't reflected on the 2020 1099-R form since I did it too late. But, I created a dummy 1099-R then included and reported the excessive amount on the 2020 return. For 2021 return, my IRA company sent me a 1099-R with the code PJ in the Box 7 for the excessive contribution.

Once you enter the distribution information from your 1099-R form, we'll help you check for any exceptions that could reduce the tax. Click here for explanation of codes for Box 7 of Form 1099-R. Click here for additional information on early withdrawals. Click here for additional information on taking an early withdrawal from your 401(K). My 1099-r has a distribution code 2b, but that is not an option in the pull down menu, how do I file that? US En . . In box 7 under distribution code it says 2B. I can choose 2 or B under the pull down menu, not both. which am I supposed to choose? . About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; Amended tax .

irs 1099 distribution codes

The core duties of a sheet metal mechanic job description include measuring, marking, cutting, bending, shaping, fitting, and permanently joining sheets of metal together using tools like shears, press brakes, welding equipment, and computer-aided machines.

the distribution code 7 on form 1099-r box 7 signifies|7d distribution code 1099